One of the things which may not be the same again is the way we learn. With growing

digitisation of education, there is a lot of interest around online classes. Inspite

of its shortcomings, online classes have advantages too. This could signal a shift

in the way institutions like IIBF ought to function going forward. The new year

will come with new expectations, new hopes, new opportunities and challenges. Challenges

will have to be converted into opportunities.

At IIBF, to keep pace with the changing times, we have redrawn our strategy on the

basis of:

- What will happen once the pandemic ends?

- How do we re-think our remote working strategies?

- How to re-orient our online classes to make them more interactive and content driven?

I would now like to walk all of you through some of the initiatives taken / will

be taken by IIBF.

Remote Proctoring Examinations

The Institute has introduced Remote Proctored Examinations. Such mode of conducting

exams allow flexibility to candidates of appearing for the exams from the comfort

of their homes while simultaneously enhancing the knowledge base. Remote proctoring

is being done in combination with AI driven auto-proctoring and physical remote

proctoring processes to ensure quality standards.

Focus on E-Learning

According to a recent study, your skills won’t last long in this fast changing

financial markets and the organisation clearly prefers work skills over degrees.

Accordingly, the most important aspect in our professional life is the ability to

“learn”, “unlearn” and relearn”.

IIBF offers e-learning covering the areas of Credit Management, MSME, AML/KYC, International

Trade Finance, Cyber & IT Security, Retail Banking, Risk, Treasury, General

Banking including Accounting & Legal Aspects of Banking, etc. I am happy to

share that many public and private sector Banks have taken our customized e-learnings

for their officers/staff. Our online learning programmes accommodate everyone’s

needs and offer impactful and updated learning contents.

Courses on the anvil

In order to keep pace with the ever-changing banking landscape, the following new

courses are being introduced:

- Resolution of Stressed Assets with special emphasis on Insolvency and Bankruptcy

Code-2016 for Bankers

- Emerging Technologies

- Strategic Management & Innovations in Banking

Professional Banker Qualification

The Institute will be introducing a gold standard aspirational qualification. This

unique qualification, which will provide cutting edge knowledge to professionals

in banking & finance fields, is expected to plug the long-felt skill gap in

mid-management levels. The details will be announced by the Institute shortly.

Training Programmes

The Advanced Management Programme (AMP), one of the flagship programmes of the Institute

which is conducted in collaboration with IIM Calcutta has been well accepted by

the banking fraternity. The current AMP batch has as many as 60 participants from

19 banks and financial institutions.

AMP programme is designed with a focus on building leadership capabilities at Banks

& Financial Institutions.

Besides the AMP, the training vertical of IIBF conducts niche programmes covering

different functional areas of the banks. New programmes on MSMEs, Agricultural Financing

have also been drawn up by the Institute. The Institute has state of the art studios

at its offices at Mumbai, Kolkata and New Delhi. This has enabled trainings to be

conducted in the virtual mode in a seamless and effective manner.

The Institute has devised customized training programmes for various Banks to cater

to their specific needs. The purpose of customized training programmes is skill

upgradation to make the employees ready to deliver on those skills

Infrastructure available at IIBF

IIBF has separate academics and training verticals at Mumbai. IIBF also has its

zonal offices christened as Professional Development Centres (PDCs) at New Delhi,

Kolkata and Chennai. The training classrooms at all the above places have state

of the art facilities.

We have recently acquired our own premises at New Delhi. This premises, located

at a central location (opposite IIT Delhi), will become operational in a couple

of months’ time and will have residential accommodation and state of the art

training facilities including a studio for virtual classroom. IIBF is thus well

placed for being the preferred academic and training partner for banks.

Collaboration with Chartered Banker Institute

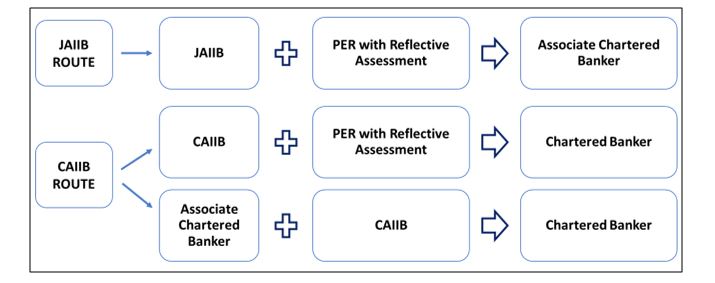

On 27th June 2017, IIBF had entered into a Mutual Recognition Agreement

(MRA) with the Chartered Banker Institute offering a pathway for the Certified Associates

of the Indian Institute of Bankers (CAIIB) from India to have their qualifications

recognised by the Chartered Banker Institute, and be able to become Chartered Bankers

by studying the Chartered Banker Institute’s Professionalism, Ethics &

Regulation module, and successfully completing a reflective assignment.

Taking forward this MRA, a pathway is now being made available for the Junior Associates

of the Indian Institute of Bankers (JAIIB) to also acquire the Chartered Banker

Status through the JAIIB Professional Conversion Route.

The date of announcing the programme will be decided in consultation with the Chartered

Banker Institute and will be announced shortly.

Please stay safe and healthy by taking appropriate precautions and by following

the advice provided by your local health authorities.

Last but not the least, I take this opportunity of wishing all of you a very happy

and prosperous New Year 2021

With warm regards,

Biswaketan Das

1st January 2021.